Empowering Businesses with Next-Gen AI, Automation & Software Solutions

Trusted by billion-dollar enterprises and powered by top-tier expertise.

WHY CHOOSE NYX WOLVES

Build. Automate. Scale - with an AI-First Approach

We are a premium Al and tech development consultancy, trusted by the world’s most innovative founders, startups, and enterprises to reform operations and accelerate growth with revolutionary Al, AR/VR, Web, and Mobile solutions.

Product Engineering

From problem framing to launch, we turn ideas into production-grade apps, APIs, and platforms that stand up to real-world demand.

Bespoke Solutions

Ready-made frameworks for automation, computer vision, Edge AI and Generative AI that snap into your stack and start adding value in weeks, not quarters.

Proactive Partnership

From onboarding to scale-up, our team works closely with yours - offering dedicated support, strategic insights, and continuous innovation.

BUILT FOR MODERN INNOVATORS

An AI-First Framework For Speed & Scalability

Nyx Wolves combines deep tech expertise with agile execution to build intelligent products, automate workflows, and scale businesses efficiently.

🤖 Rapid AI Go-Live

Ship a production-grade MVP in weeks- no heavy onboarding, no vendor lock-in.

🧠 Human-Centric Design

UX that earns trust and drives adoption across every stakeholder group.

🔗 Seamless Integration

Pre-built connectors and open APIs slide straight into your current stack.

📱 Scalable Framework

Cloud, mobile, and edge deployments that auto-scale as your usage spikes.

OUR CORE SERVICES

AI-Powered Services Designed for Excellence & Scale

Delivering Innovation, Impact, and Results Across Every Solution

AI & IT Consultation

Strategic AI advisory & technology consultation to align innovation with business goals.

Business Automation & Digital Transformation

Automating workflows in operations, HR, finance, marketing, and legacy system modernization.

Research & Development

AI and AR/VR innovation for cutting-edge prototypes and industry-first solutions.

Product Development

Building custom software, mobile apps, and AI-driven platforms to solve real-world challenges.

HIGHLIGHTS OF OUR JOURNEY

Our Milestones of Transformative Impact

Achieved a 25% reduction in carbon emissions by implementing AI-powered energy optimization solutions, driving sustainable transformation across operations.

OUR AI DRIVEN PROCESS

Your Quick Start to AI Integration

Seamless onboarding, smart execution, and measurable impact from day one.

-

── Discovery & Strategy

── Discovery & Strategy

Identifying core challenges & opportunities.

-

── Solution Design

── Solution Design

Tailoring AI & software solutions for maximum impact.

-

── Development & Integration

── Development & Integration

Building robust, scalable systems.

-

── Testing & Optimization

── Testing & Optimization

Ensuring peak performance, reliability, and security.

-

── Deployment & Continuous Support

── Deployment & Continuous Support

Long-term maintenance and innovation.

What Happens When

IBM Meets Nyx AI Power

SUCCESS STORIES

Real-World Innovation Success

Automated Water Filling System

Real-Time Monitoring

Logistics Automation

Automated Water Filling System

This technology is an AI-driven automated water filling system that utilizes computer vision, ALPR, and a real-time dashboard to enhance efficiency, safety, and accuracy for logistics operations in tanker bay areas.

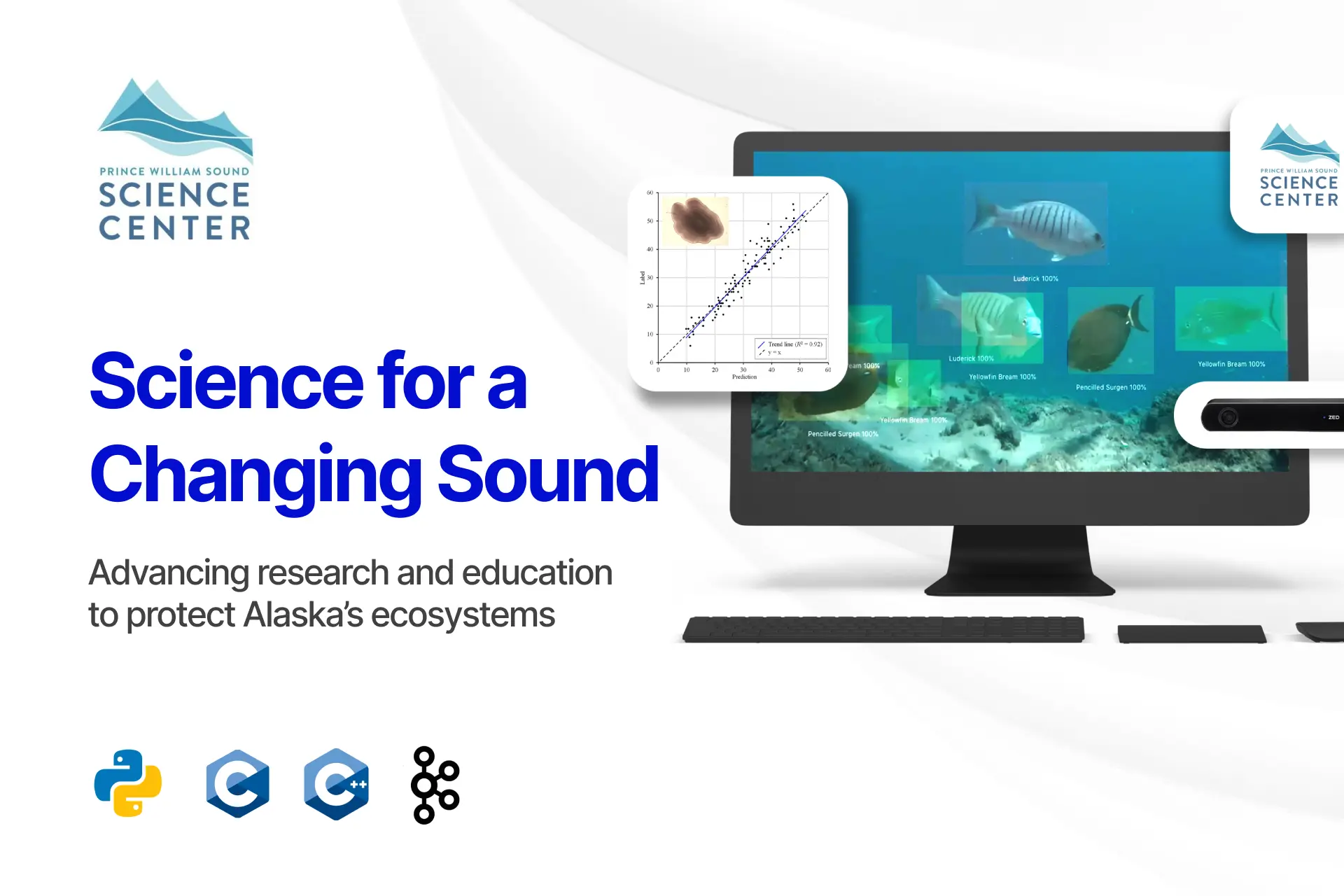

Fish Counting

Scientific Research

Waterway Ecosystem

Accurately Detecting and Counting Fish to Aid in Weather Research

PWSSC is an AI-powered fish monitoring system that uses advanced computer vision to improve fish counting and species identification, aiding ecological and weather-related research.

No-Code Platform

3D Product Views

AR Customization

Revolutionizing Online Product Showcase with No-Code WebAR

Xarwin is transforming the way businesses showcase real-world products online by offering a no-code platform for creating immersive WebAR experiences.

Got an idea, challenge, or product to scale?

See how we help companies of all sizes become truly AI-first — from consulting to full-scale delivery.

OUR CLIENTELE

Trusted by Industry Leaders

Real feedback from global enterprises that rely on Nyx for secure, high-performance AI delivery.

Their AI-driven solutions streamlined our business processes by 70%, boosting our operational efficiency.

~ Hanno Van Arde, CEO, Briisk

Nyx Wolves’ AI helped us unlock insights we couldn’t see before, making a game-changing impact on our research.

~ Peter S, Prince William Science Center, Alaska

Nyx Wolves made AI automation simple and effective for us. Their expertise improved efficiency across the board.

~ Mohit Sibal, Bahri

Their AI-driven solutions streamlined our business processes by 70%, boosting our operational efficiency.

~ Hanno Van Arde, CEO, Briisk

Nyx Wolves’ AI helped us unlock insights we couldn’t see before, making a game-changing impact on our research.

~ Peter S, Prince William Science Center, Alaska

Nyx Wolves made AI automation simple and effective for us. Their expertise improved efficiency across the board.

~ Mohit Sibal, Bahri

Their AI-driven solutions streamlined our business processes by 70%, boosting our operational efficiency.

~ Hanno Van Arde, CEO, Briisk

Nyx Wolves’ AI helped us unlock insights we couldn’t see before, making a game-changing impact on our research.

~ Peter S, Prince William Science Center, Alaska

Nyx Wolves made AI automation simple and effective for us. Their expertise improved efficiency across the board.

~ Mohit Sibal, Bahri

Their AI-driven solutions streamlined our business processes by 70%, boosting our operational efficiency.

~ Hanno Van Arde, CEO, Briisk

Nyx Wolves’ AI helped us unlock insights we couldn’t see before, making a game-changing impact on our research.

~ Peter S, Prince William Science Center, Alaska

Nyx Wolves made AI automation simple and effective for us. Their expertise improved efficiency across the board.

~ Mohit Sibal, Bahri

PLATFROM PARTNERSHIP

Platform Synergy: Scaling Possibilities

Leveraging shared strengths to deliver smarter, faster,

and more impactful solutions.

FOUNDING LEADERSHIP

Meet the Strategic Leadership Team

Just a team of talented, dedicated pros making magic

happen behind the scenes.

Ready to Scale with AI & Intelligent Automation?

See how we help companies of all sizes become truly AI-first — from consulting to full-scale delivery.

BLOGS

Explore the Latest Insights

Dive into our blog for tips, trends, and expert advice on

making the most of Nyx Wolves.